Abstract

- Beware phishing emails focusing on folks not cautious with private info.

- Third-party distributors acquire information for adverts; know the place your information goes.

- Use disposable bank cards for monetary safety, setting limits and avoiding subscription renewals.

Some folks do not take their safety and id severely. There is a motive that scammers have created issues like phishing emails, which goal individuals who might not have good filters on their e mail bins and do not take note of what an e mail says earlier than clicking a hyperlink. They continue to be efficient, which is why lots of them nonetheless exist right this moment. In case you are somebody that is not cautious together with your personal information, there may be nonetheless time to vary.

Monetary information could be shared fairly rapidly and effortlessly. With a view to take an additional step in that safety, you may strive utilizing a disposable bank card. Disposable credit cards are sometimes generally known as digital bank cards. A disposable bank card is one that’s offered to you by your bank card firm. It’s meant for use whereas on-line purchasing and is a digital bank card with a distinct quantity than your regular bank card. That is achieved to guard your common bank card quantity. You will not get the identical quantity twice for those who use a disposable bank card for an internet buy. It’s a quantity that’s linked to your account however just isn’t the quantity in your bank card. Listed below are some the reason why you would possibly use a disposable bank card.

Associated

This VPN feels like it’s in a league of its own

On the finish of the day, you need to decide one which’s best for you.

5

You make an enormous buy

This protects your info from being stolen

cardmapr-nl / Unsplash

The numbers on a disposable bank card are, by design, solely good for one buy. It’s then made invalid by the bank card firm, defending your id and private info whereas permitting you to make an enormous buy with out worrying about your precise bank card quantity being compromised.

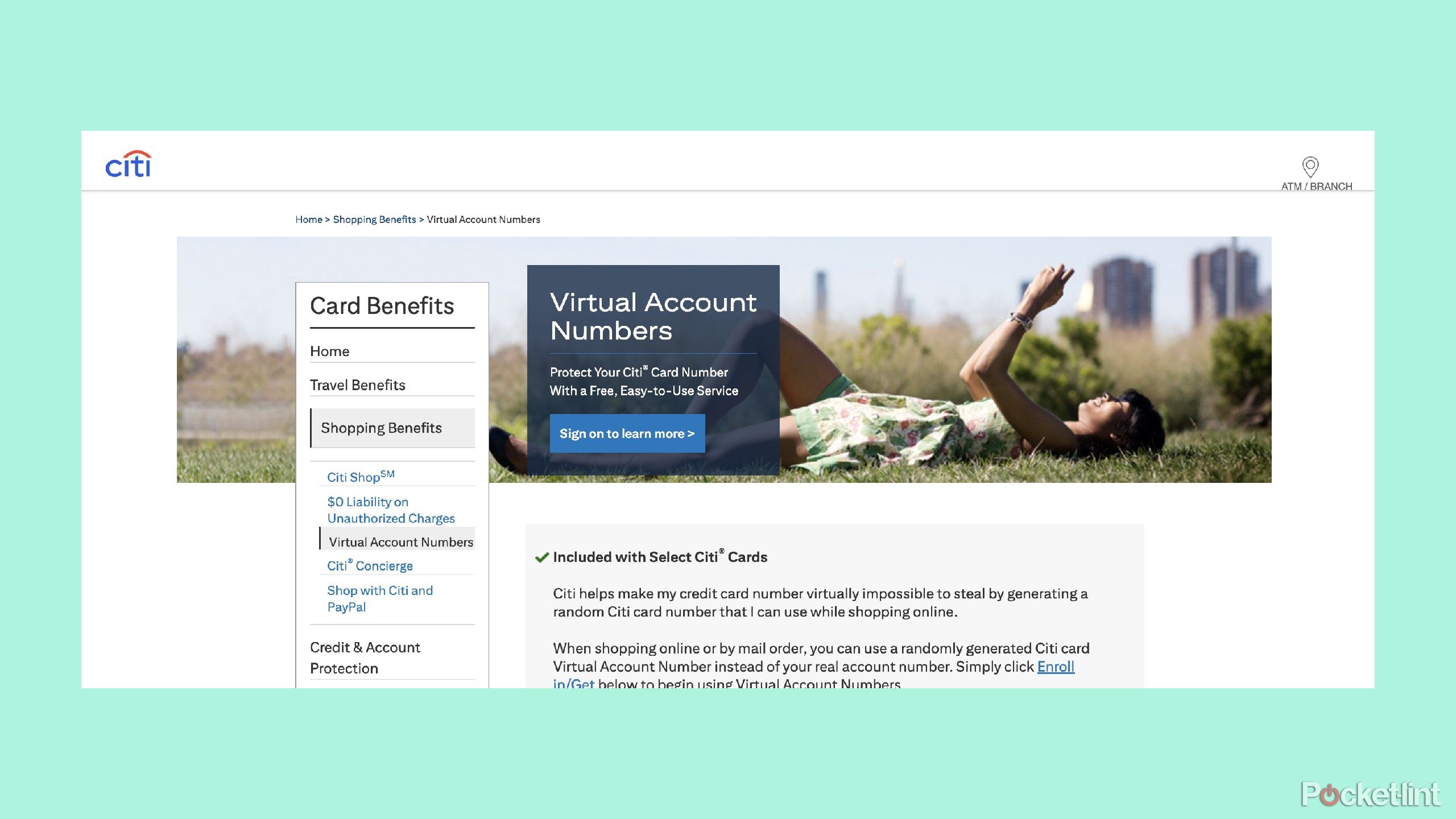

Digital bank cards have been accessible by some corporations for the reason that early 2000s.

There are solely two bank card corporations that at present supply digital bank cards. Capital One and Citibank enable customers to join digital bank cards. They have been beforehand provided by American Specific and Uncover, however are now not choices with both firm.

Utilizing a bank card with a disposable quantity is sensible if you find yourself making a big buy and wish to shield your info. This may just be sure you’re solely charged as soon as to your account for that quantity, including an additional layer of safety to your account. It is usually a good suggestion to think about using this type of bank card for those who’re buying from a web site which may not have the very best safety round it. Utilizing a browser that may flag unsafe web sites may also cease you from doing this.

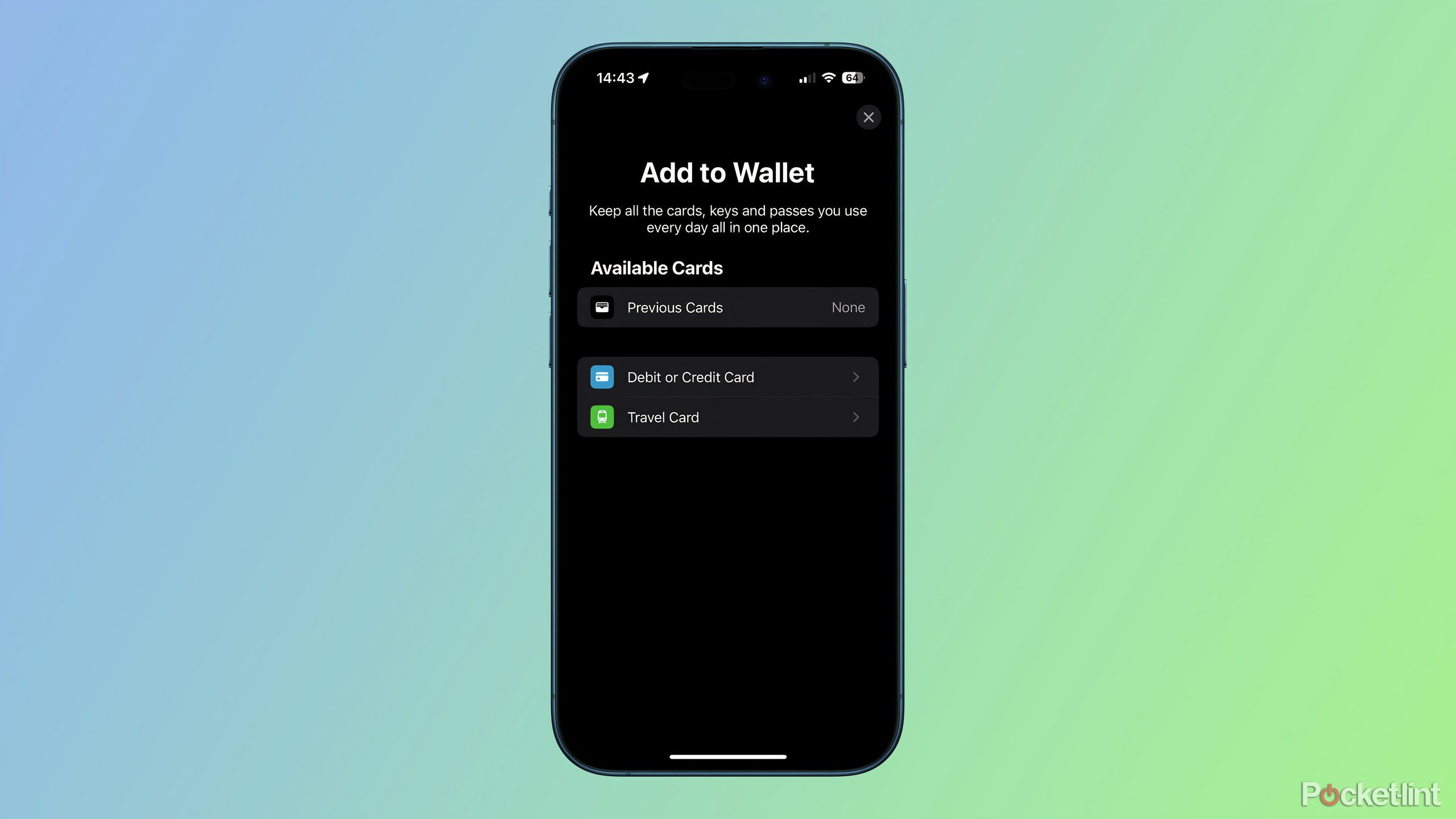

Associated

5 Apple Pay moves that make checkout faster, smarter, and better

You undoubtedly aren’t utilizing Apple Pay proper if you do not know these tips.

4

When you do not wish to overspend

Not a foul concept for somebody studying to make use of a bank card

For any bank card, you may set a restrict for the way a lot you are allowed to spend at a given time. Usually, folks simply depart it because the set restrict allowed by the bank card firm. However, if you wish to cease your self from making giant purchases, you may organize for a disposable bank card quantity to be linked to a sure amount of cash. Which means, if you use the digital bank card quantity, you may solely use it for a certain quantity.

You have not used it in months however now you are paying for it for an additional 12 months. Utilizing a one-time bank card quantity would cease that.

It’s sensible to place a cap in your spending and utilizing a digital quantity is an efficient approach to do that. While you activate the characteristic with both Citibank or Capital One (in case your card provides this,) you may designate the quantity you may spend with it. It is a good concept for somebody who could also be studying find out how to use credit score and is making an attempt to construct some up by making smaller purchases.

Associated

As a rule, any safety threats are oblique fairly than by way of Apple Pay itself.

3

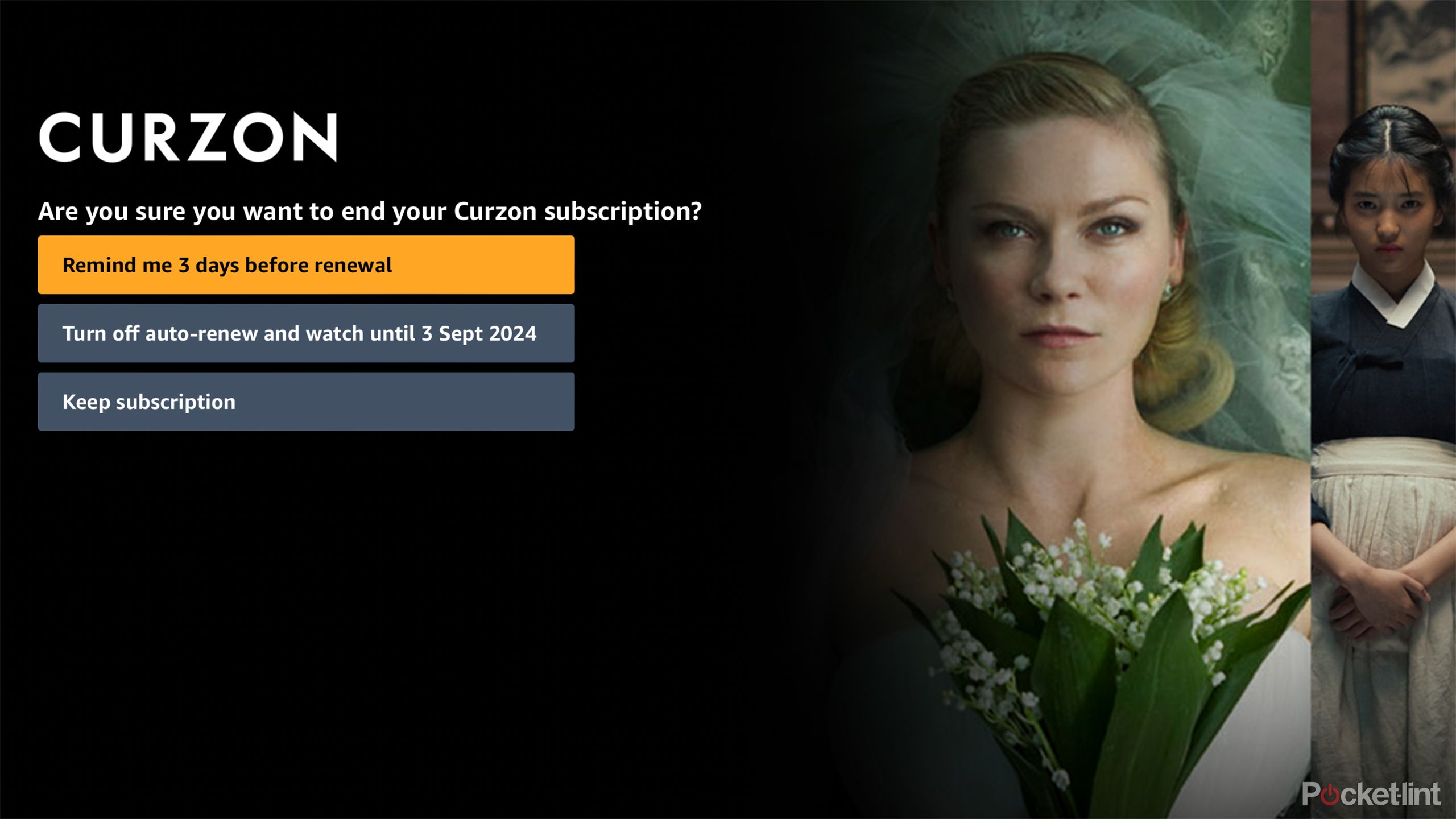

Cease a renewal in its tracks

Do not get hit up twice for a similar buy

To illustrate you are signing up for a brand new streaming service since you wish to watch a particular present on it. You recognize it is going to take you longer than the trial interval to take action, that means your cost will get charged a minimum of as soon as. If you recognize that you don’t need the service after ending this one present, utilizing a digital bank card quantity will get rid of the likelihood that it auto-renews.

Loads of us are horrible at remembering to cancel a subscription as a result of we simply overlook. It is an annoying cost to search out in your bank card assertion {that a} random subscription auto-renewed since you merely forgot to cancel it. You have not used it in months, however now you are paying for it for an additional 12 months. Utilizing a one-time bank card quantity would cease that.

Associated

I just found a goldmine of top-tier shows – no subscription required

Tubi is the place to go for the very best in traditional TV.

2

When you do not wish to maintain utilizing the cardboard

There are methods to cease your self from utilizing it

If you recognize you wish to use a digital bank card however you are not certain when, you may enroll for one proper now. Any time you wish to use it, your card will offer you a brand new bank card quantity. However, you too can cease utilizing the digital numbers at any time. That is as a result of you’ve gotten the choice of selecting how lengthy you are allowed to make use of them.

Which means you’ve gotten the flexibility to regulate how usually and the way little you utilize a disposable bank card. You possibly can set a time period restrict that claims you should use it for a 12 months after which you need to return to utilizing your common bank card quantity. Any time you will be utilizing the service, your bank card firm will create a brand new quantity for you in that occasion. It’s nonetheless linked to your bank card account, however is not accessible for a couple of use. After a 12 months or regardless of the restrict you’ve gotten set in your account, this would possibly not be the case anymore.

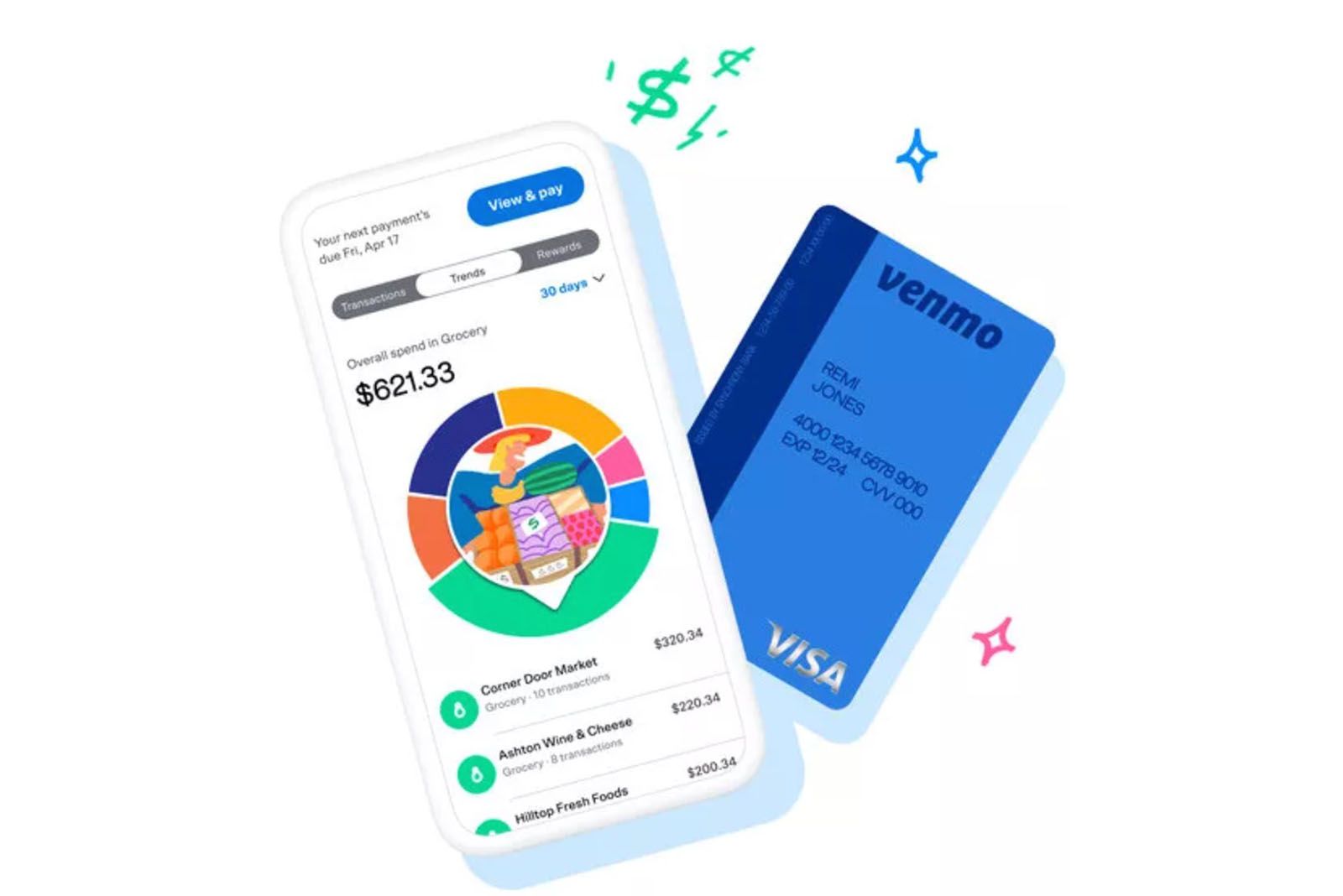

Associated

What is the Venmo Credit Card, how does it work, and does it offer rewards?

Do you know Venmo provides a bank card?

1

While you wish to order one thing on the telephone

It is arduous to belief somebody to not use your card

Making an attempt to position an order for one thing over the telephone? It may be dangerous to present somebody your bank card quantity whereas speaking to them. They should ask your title, bank card quantity, expiration date, and CSV code. That is just about giving them every thing they should know to make use of your bank card once more. In case you are making a purchase order and really feel uncomfortable offering all of that info over the telephone, utilizing your disposable bank card quantity might be the appropriate transfer.

You’ll need to verify together with your bank card supplier if this can be a chance. It has occurred previously the place bank card corporations solely allowed digital bank cards for on-line purchases. However, it’s attainable you could be licensed to make use of it for a over-the-phone transaction. Perceive what your organization’s coverage is earlier than you do this.

Trending Merchandise

Wireless Keyboard and Mouse Combo – RGB Back...

Wi-fi Keyboard and Mouse Combo – Full-Sized ...

Acer Nitro 31.5″ FHD 1920 x 1080 1500R Curve...

SAMSUNG 27″ Odyssey G32A FHD 1ms 165Hz Gamin...

NETGEAR Nighthawk WiFi 6 Router (RAX54S) AX5400 5....